Key Takeaways

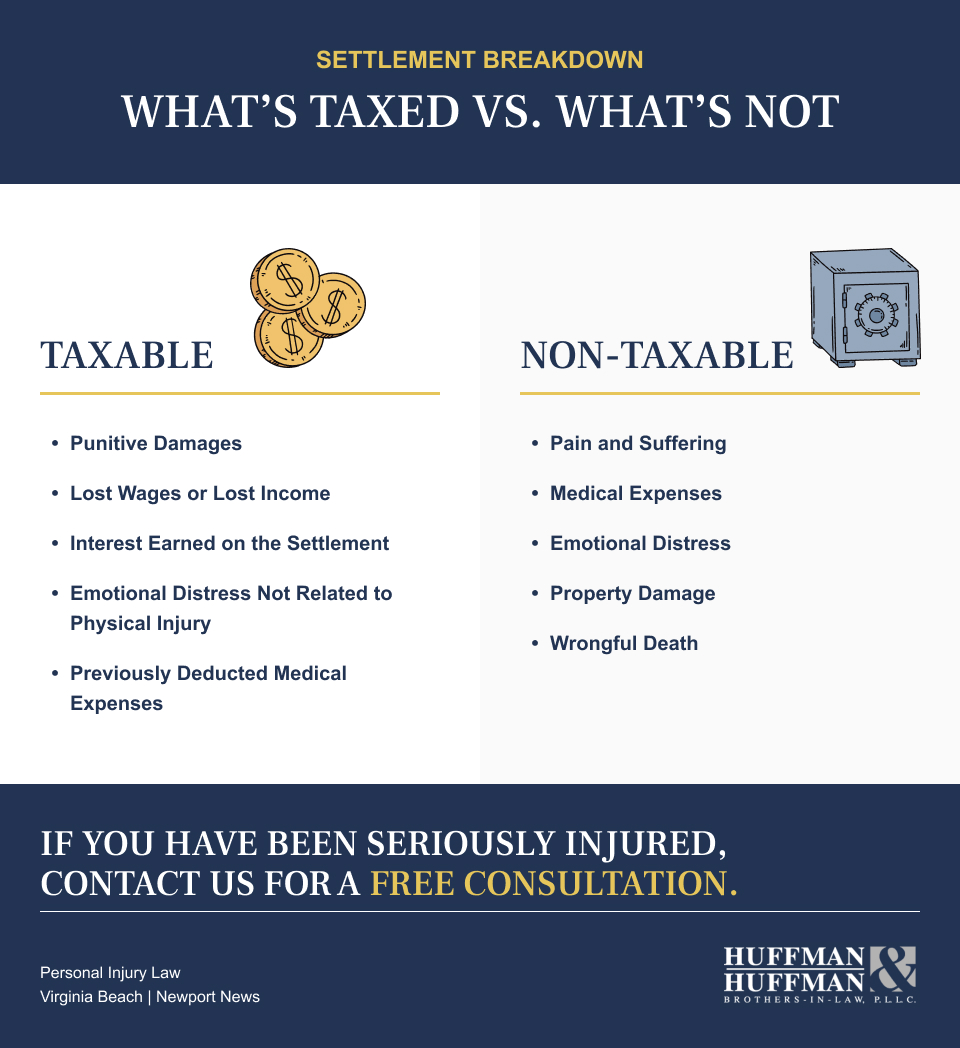

- Most personal injury settlements are not taxable if they compensate for physical injuries, sickness, or related pain and suffering.

- Portions covering lost wages, punitive damages, or interest may be taxed under both federal and Virginia law.

- Clear documentation and early tax advice are essential to protect your non-taxable compensation and avoid IRS issues later.

Whether you’ve just started the process of filing a personal injury claim or are already negotiating a settlement, you may be wondering how taxes could affect the compensation you receive. The short answer is that whether your settlement is considered taxable depends on what the compensation is for. Some settlements may not be taxable at all, while others may be taxable in part.

Understanding how federal tax law applies to your situation can help you set realistic expectations and avoid surprises when tax season arrives.

When Are Personal Injury Settlements Not Taxable?

In many cases, the money you receive from a personal injury settlement is not taxable under federal law. The IRS generally excludes damages received for physical injuries or physical sickness from your gross income. That means if your settlement compensates you for the harm you suffered in an accident, you typically do not owe personal injury settlement tax on that portion.

Here are the types of settlement payments that are usually not taxed:

- Medical Expenses: Compensation for hospital bills, physical therapy, surgery, prescriptions, or other medical costs related to your injury is not taxable, unless you previously claimed those expenses as deductions on a prior tax return.

- Pain and Suffering: Damages for physical pain, emotional suffering, and the long-term impact of physical injuries are generally excluded from taxable income.

- Emotional Distress: If emotional distress stems directly from a physical injury or illness, it is not taxable. However, if it is unrelated to a physical injury, it may be taxable.

- Property Damage: Settlement funds meant to repair or replace your damaged property, such as a car, are typically not subject to personal injury lawsuit settlement taxes.

- Wrongful Death: In wrongful death cases, the settlement amount received by survivors for the loss of a loved one’s life is generally tax-free under federal law.

In short, if your damages directly relate to a physical injury or illness, those parts of your personal injury settlement will usually not increase your taxable income.

When Can Personal Injury Settlements Be Taxed?

While many personal injury settlements are tax-free, there are several situations where portions of your settlement can be taxable. The IRS considers certain types of compensation as income, even when they arise from a personal injury lawsuit.

Here are common examples where you may owe taxes:

- Punitive Damages: These are meant to punish the at-fault party rather than compensate you for your losses. Because they are not tied to your actual injuries, the IRS treats them as taxable income.

- Lost Wages or Lost Income: If part of your settlement covers wages or earnings you would have received had you not been injured, that amount is taxable. This is because regular wages are subject to income tax.

- Interest Earned on the Settlement: Sometimes, a settlement accrues interest while negotiations or appeals are pending. Any interest earned is taxable.

- Emotional Distress Not Related to Physical Injury: If your emotional distress or mental anguish did not arise from a physical injury (for example, from discrimination or defamation), those damages are taxable.

- Previously Deducted Medical Expenses: If you deducted medical expenses for the same injury in prior years, and your settlement reimburses those expenses, you must include that portion in your taxable income.

In addition to federal taxes, state taxes will also apply. In Virginia, the state generally taxes the same portions of settlements listed above.

Practical Steps for Handling Taxes on Your Injury Settlement

Knowing the potential tax implications before your case concludes can save you time, stress, and money later. Here are a few practical steps to help manage taxes on a settlement for personal injury:

Keep Detailed Documentation

Ask your attorney to clearly outline how the settlement amount is allocated and what portion covers medical bills, lost wages, emotional distress, or punitive damages. The IRS examines how a settlement is described in your agreement, so clear documentation is key to protecting your non-taxable compensation.

Consult a Tax Professional Early

Even if your attorney provides general guidance, a certified tax professional or CPA can ensure that your tax filing accurately reflects your settlement’s taxable and non-taxable portions. They can also help with specific IRS forms, such as Form 1040 Schedule 1, where “Other Income” (like taxable damages) may need to be reported.

Consider a Structured Settlement

In some cases, receiving your settlement as a structured payout, rather than a single lump sum, can reduce your tax burden or make it easier to manage taxable income over time. A structured settlement spreads payments out across months or years, which may help you stay within a lower tax bracket.

Plan Ahead for Tax Season

If part of your settlement is taxable (for instance, punitive damages or lost wages), set aside a portion of those funds for taxes. It is better to plan ahead than face unexpected tax bills later.

Revisit Your Prior Deductions

If you previously deducted medical expenses for the same injuries, talk to your accountant about how to handle that in the year you receive your settlement. You may need to include that reimbursed portion in your taxable income.

Keep Your Settlement Records

Maintain copies of your settlement agreement, medical bills, correspondence, and IRS filings for several years. These records may be needed if the IRS questions your tax return or if you file an amended return later.

Understanding Injury Settlement Taxes Helps Set the Right Expectations

It can be confusing to determine whether your settlement is taxable, especially since a personal injury lawsuit settlement can include several types of damages. Some are tax-free; others are not. For example, your compensation for physical injuries may be non-taxable, while money for lost wages or punitive damages will be taxed.

By understanding how the IRS handles personal injury settlements and taxes, you can avoid surprises and ensure you comply with both state and federal tax laws.

If you are considering accepting a settlement offer, we encourage you to reach out to Huffman & Huffman Brothers-in-Law. We can help you understand whether the offer accurately reflects the losses you’ve suffered and how taxes may come into play. If you haven’t yet filed a claim, we can guide you through the process and clarify the tax implications of your potential recovery. Schedule your free consultation today.